Stash Investment App: Investing Made Simple for Beginners on a Budget

As a single mom of two kids, I started to use Stash because it gives me a simple, affordable way to build a better future—for myself and my children. I don’t have a lot of extra money each month, but with Stash, I can invest as little as $5 at a time (and yes I invest only $5 a week, unfortunately), right from my phone. It fits into my busy schedule and tight budget without adding stress. I love that I can set up automatic deposits, have the potential to earn rewards with their Stock-Back® card (I don’t because I only invest, I do not use the banking option), and even start a small retirement fund—all in one place. Stash makes me feel more confident and in control of my finances, and that peace of mind is something every parent deserves.

Stash is a powerful yet beginner-friendly investment app built to help everyday people start investing—without needing to be wealthy or financially savvy. Whether you're a student, a parent, or simply someone looking to grow your savings gradually, Stash lets you invest from home on your terms. With no intimidating jargon or large up-front requirements, the app is designed to support long-term wealth building through small, consistent steps.

For those who only have a few dollars to spare each week or month, Stash removes the usual roadblocks and empowers you to take control of your finances. You can invest in your favorite companies or themed portfolios, automate your strategy, and learn along the way—all from the palm of your hand.

Why Stash Is Perfect for First-Time Investors on a Budget:

Invest with as little as $5: Start small and grow over time—ideal for tight budgets.

Fractional shares: Buy portions of expensive stocks, so you can own part of companies like Apple, Google, or Tesla without needing hundreds of dollars.

Automatic investing: Set up recurring weekly or monthly deposits to build your portfolio steadily and effortlessly.

Round-Up feature: Link your bank account and automatically invest spare change from everyday purchases.

Educational tools: In-app guidance, tips, and beginner-friendly articles help you understand investing basics while you build your portfolio.

No experience required: Designed for people new to investing, with simplified choices and risk-based guidance to help you feel confident.

Additional Features That Set Stash Apart:

Banking with benefits: Includes access to a Stash banking account with a debit card, no hidden fees, and automatic saving tools.

Stock-Back® rewards: Earn fractional shares of stock when you spend with your Stash debit card at select retailers.

Retirement accounts: Start planning long-term with access to traditional and Roth IRAs, even with low monthly contributions.

Smart Portfolio (Robo-advisor option): Let Stash manage a diversified portfolio for you based on your goals and risk level.

Budgeting tools: Track spending and set savings goals directly in the app for better financial control.

Family investing: Offers accounts for kids so you can teach financial literacy early.

With Stash, first-time investors can start building a solid financial foundation from home—without pressure, high costs, or complicated decisions. It's an all-in-one solution for anyone ready to take small steps toward big financial goals. Stash offers two monthly plans, one at $3/month and the other at $9/month. The more costly plan has its perks, but none that I find extremely necessary, so I have opted for the $3 plan since I opened my account. Check out some of the visuals below:

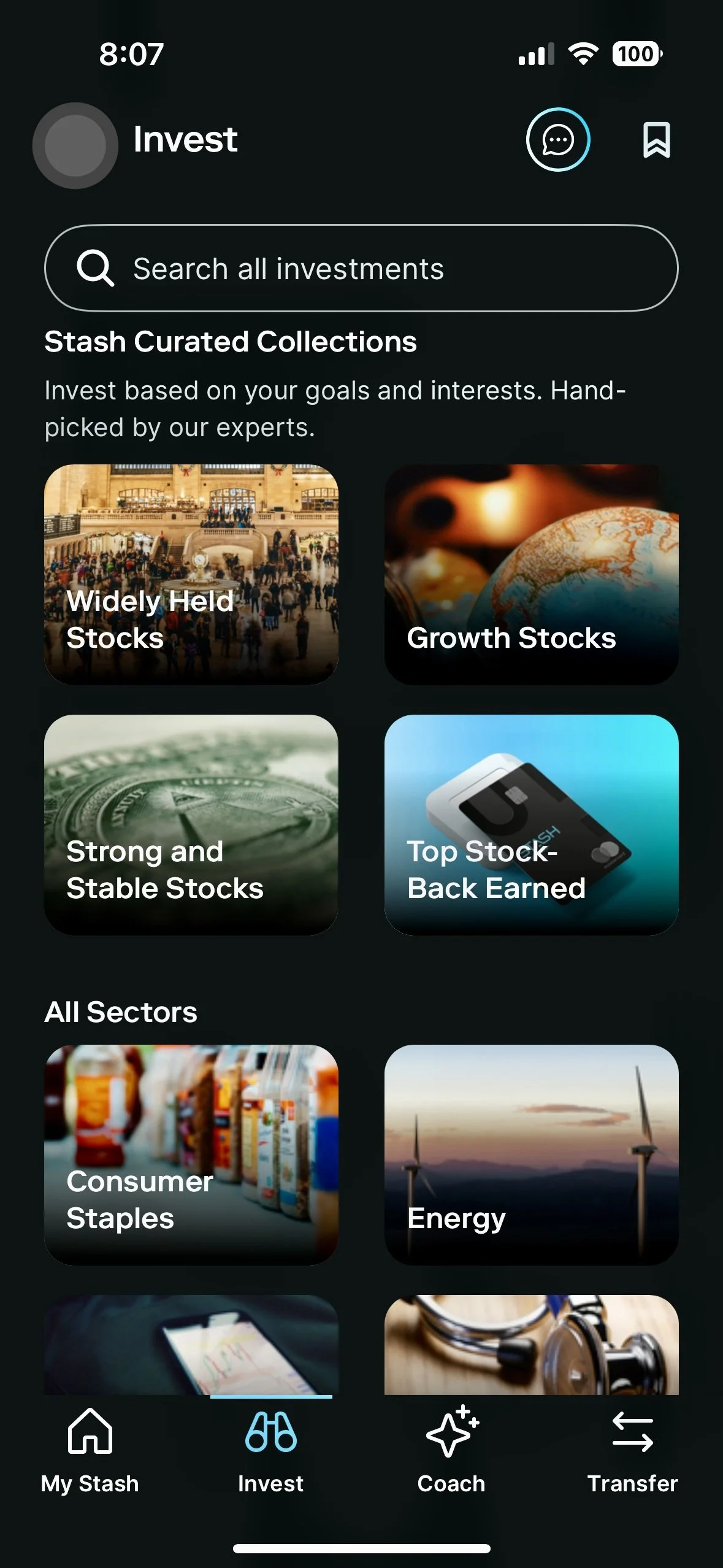

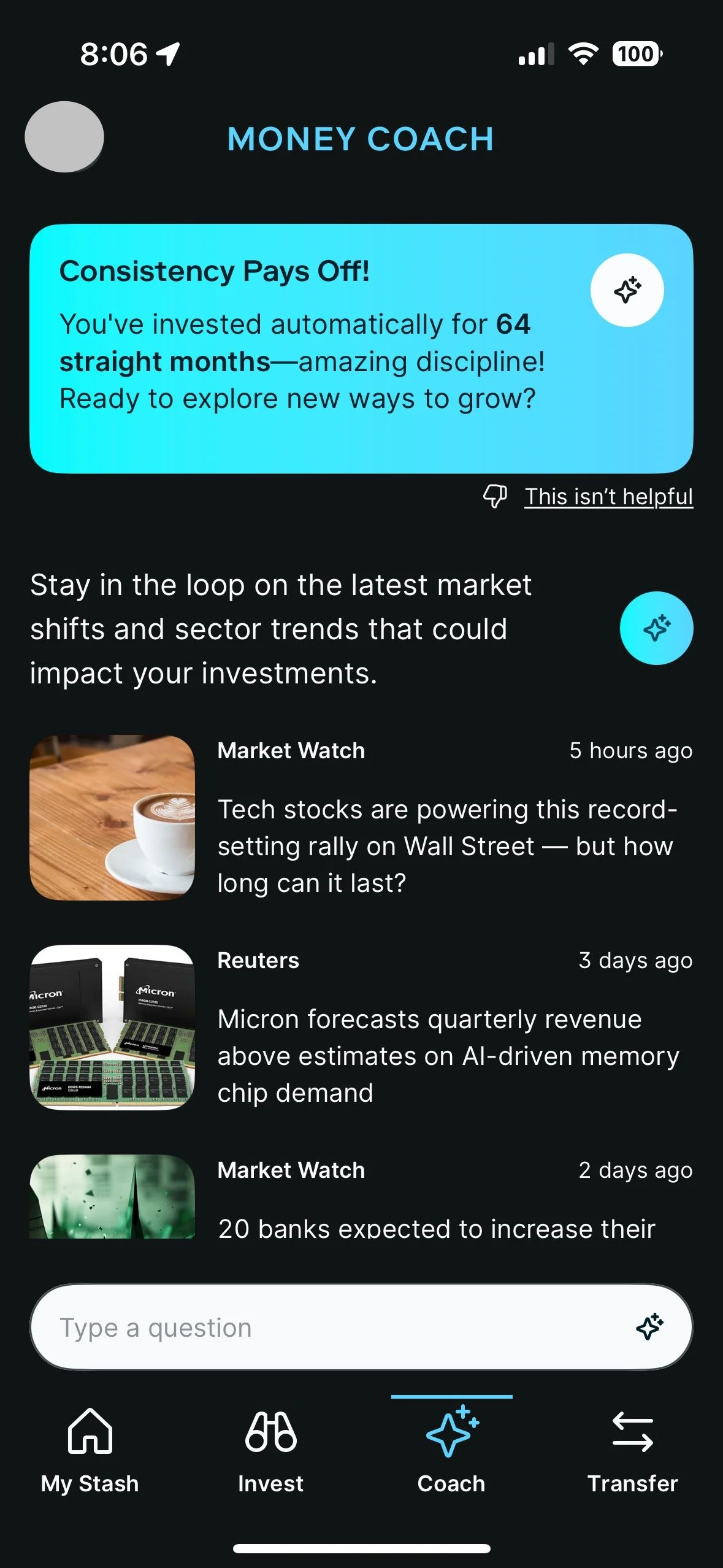

The images above show different screens on my Stash app.

The first is my Welcome screen. I provides a brief summary of how my portfolio is doing and let’s you compare its performance over different time frames. It will also provide you with the percentage that you are in up or down in the market.

The second and third images are part of their curated choices for you based on the investment needs or goals you indicated when signing up. You can change these needs or goals at any time in your profile. This collection includes individual stocks and ETFs.

The last image is the Money Coach section that will provide you with different articles and helpful hints if you are courageous and would like to take some picks on your own.

If you choose to sign up for Stash, please use my referral code included in this link.